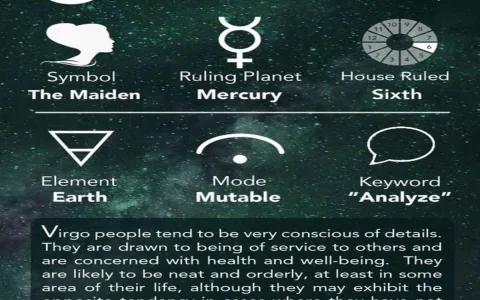

So this Virgo money forecast thing popped up in my feed, right? Oracle monthly something or other. Usually ignore those, but heck, felt like trying something different. Got curious: what if I actually followed one for a month? Just see what happens. No big expectations.

The Setup Phase

First things first: grabbed an old notebook. Dusted it off literally. Needed a place to scribble notes. Found the full forecast online – didn’t pay for any fancy readings, just the freebie summary everyone gets. Key points for Virgos this month: “Slow steady gains,” “focus on debts,” and “unexpected opportunity needs scrutiny.” Vague, sure, but whatever.

- Step 1: Wrote the key phrases down in the notebook. Top of a fresh page. Real official.

- Step 2: Scrolled through comments. People were either super excited or calling it trash. Typical.

- Step 3: Made a quick list of my own money stuff: current bills, that nagging credit card balance, my usual monthly spending spots. Basic money map.

Putting It Into Practice (Or Trying To)

Okay, month starts. Tried to keep the “slow steady gains” in mind. Normally, I’d see a small freelance gig, blow the cash immediately on takeout. This month? Actually dumped the little bits into that credit card debt. Felt… painfully responsible.

- The Debt Thing: Every time I found “extra” money – leftover grocery cash, that refund from Amazon – straight to the card balance. Small chunks.

- “Focus on Debts”: Sat down one Sunday afternoon. Hated it. Actually opened all the bank apps and credit card websites I usually avoid. Added up the real total damage. Wrote the ugly number in the notebook. Yuck.

- The “Opportunity” Surprise: Week two, buddy texts. “Quick gig! Easy cash! Need your skills!” Normally, I’d jump. But “scrutiny” echoed in my head. Asked way more questions than usual. Turns out the pay wasn’t great, timeline was crazy tight. Actually said no. Felt weirdly powerful. And disappointing. Mostly disappointing.

Also, tried to track spending roughly in the notebook. Not fancy apps, just scribbles: “Lunch $12,” “Gas $40,” “Coffee machine impulse buy… ($85 why??).” Seeing it on paper made me wince more than usual.

Mid-Month Panic & Course Correction

Hit a wall halfway. Notebook felt stupid. Felt like doing homework. Almost tossed it. The debt number stared back. Then my car made a scary noise. Brakes. Unexpected expense. Crap.

- Emergency Fund? What’s That? Yeah, didn’t really have one. Stupid. Used the credit card I was trying to pay down. Major fail. Oracle didn’t predict my jalopy dying.

- What Now? Felt defeated. Looked back at the forecast. “Slow steady gains” felt like a cruel joke. Almost gave up the whole experiment. Shoved the notebook in a drawer.

Finishing the Month (Mostly)

Took a few days to sulk. Then fished the notebook out. The debt total now included car repairs. Awesome. But seeing it written… idk, made the problem real. Started pinching pennies harder. Ate home more. Skipped that concert I couldn’t afford.

End of the month? Total money picture still sucked. But:

- Small Wins: Paid more than minimums thanks to those micro-payments.

- Awareness Boost: The scribbles showed where cash was actually leaking (so much takeout).

- Filtered an “Opportunity”: Saying no to my buddy saved me a huge headache, even if it meant less cash short-term.

And the brake bill? Didn’t wipe me out completely because I’d slightly chipped away at the other card. Small mercies.

Final Thoughts (Scribbled Messily)

Was it magic? Nope. Did the Oracle “predict” my exact month? Heck no. But using it as a loose framework? Kinda worked? Forced me to do boring money stuff I always postpone. The “scrutiny” advice? Probably saved me. “Focus on debts”? Made me face it, at least once.

Biggest takeaway? Tracking anything, even poorly, shines a light. And “slow steady gains”? Means doing the boring stuff consistently. This ain’t a lottery ticket forecast. It’s a nag to be mindful. Might try next month’s… with a bigger emergency fund goal. And maybe less dust on the notebook.

Weirdly, doing this felt less like trusting stars, more like proving to myself I can manage money if I just pay attention. Shocker.