Man, November hit me like a truck, financially speaking. Felt like my cash was just doing a disappearing act every other day. You know that feeling, right? Like you’re working your tail off, money comes in, and then poof, it’s gone, and you got no clue where it went. I’m a Virgo, supposedly all organized and stuff, but my money situation was anything but. So, I figured, November was the month to finally get a grip. Enough was enough of just guessing and shrugging my shoulders. I needed to see the actual numbers, clear as day.

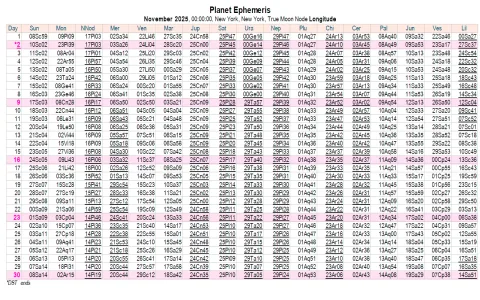

First thing I did, and it wasn’t pretty, was just gather everything. I mean everything. I fired up my online banking, logged into every credit card account I had, even dug out some old PayPal statements. It was a digital treasure hunt, only the treasure was just a pile of transactions. I pulled all that data, month of November specifically, and just started dumping it. Had an old, crusty Excel sheet sitting on my desktop from like, five years ago. Dusted it off, figured it’d do the job. No fancy apps, no subscription services, just pure, manual entry. Yeah, it was a pain in the butt, took me a couple of evenings after work, just typing in dates, descriptions, and amounts. My eyes were practically bleeding by the time I was done.

Once all the numbers were in, the real “fun” began. I started categorizing. This was where the actual brainwork happened. I had my standard buckets: ‘Rent/Bills’ (the non-negotiables), ‘Groceries’, ‘Eating Out’ (because those are two very different beasts, trust me), ‘Transport/Fuel’, ‘Subscriptions’, and then the big, scary one: ‘Just Random Stuff’. That ‘Random Stuff’ category was actually an eye-opener all by itself. I mean, who needs three new coffee mugs in one month? Apparently, I did, according to my bank statements.

What Hit Me Like a Ton of Bricks

- Food, Glorious, Expensive Food: This one was massive. Like, ridiculously big. I always thought I was pretty good with groceries, cooking at home most nights. Nope. The “Eating Out” column was insane. All those quick lunches, the coffees on the way to work, a couple of dinners with friends. Individually, they felt small, painless. But when you add up twenty small pains, you get one giant headache. It was way more than my actual grocery bill, which just blew my mind.

- Subscription Creep: Good lord, the subscriptions. Found three I hadn’t used in months, maybe even a year. Just letting them auto-renew, silently draining my account. One was for some fitness app I tried for two days and hated. Another was a streaming service I watched exactly one show on. And the third? I honestly couldn’t even tell you what it was for. Straight-up forgotten money, just floating away.

- The “Little Things” Addiction: This goes back to ‘Random Stuff’. A book here, a gadget accessory there, a new shirt I probably didn’t need because it was on sale. Each item felt like a negligible amount at the time. “Oh, it’s only twenty bucks,” I’d tell myself. But when you see a list of ten “only twenty bucks” items in one month, you start to realize that’s two hundred bucks that could’ve gone somewhere useful. It’s like death by a thousand paper cuts, but with my wallet.

- Weekend Warriors: My spending spiked big-time on weekends. Weekdays were relatively stable, just commute, work, home, maybe groceries. But Friday night hit, and suddenly it was brunch on Saturday, drinks Saturday night, maybe a concert or an outing on Sunday. It was like a different person took over my finances for those two days. The contrast was stark.

Sitting there, staring at that spreadsheet, it wasn’t a pretty picture. It was a messy, disorganized, somewhat embarrassing picture of my financial habits. But you know what? It was also incredibly liberating. For the first time, I wasn’t just feeling broke; I was seeing why. I wasn’t just wondering where my money went; I had a literal map of its journey.

The biggest insight wasn’t just about cutting costs, though that’s a big part of it. It was about awareness. I’d been living in the dark, letting my money just happen. Now, I had a spotlight on it. It wasn’t about deprivation, it was about redirection. Instead of letting money leak through forgotten subscriptions, I could put that towards something I actually wanted or needed. Instead of endless takeout, maybe I could learn a few new recipes and save a ton.

So, November’s money dive, as brutal as it was, became this huge wake-up call. It wasn’t just about the numbers; it was about shifting my mindset. I closed out the month feeling not poorer, but richer in knowledge. Richer in understanding. And that, my friends, felt like a win.