Today I’m spilling the beans on my messy trial-and-error journey with gold crosses. Spoiler: it ain’t as magical as those YouTube gurus make it seem. Buckle up.

Getting Obsessed After a Loss Streak

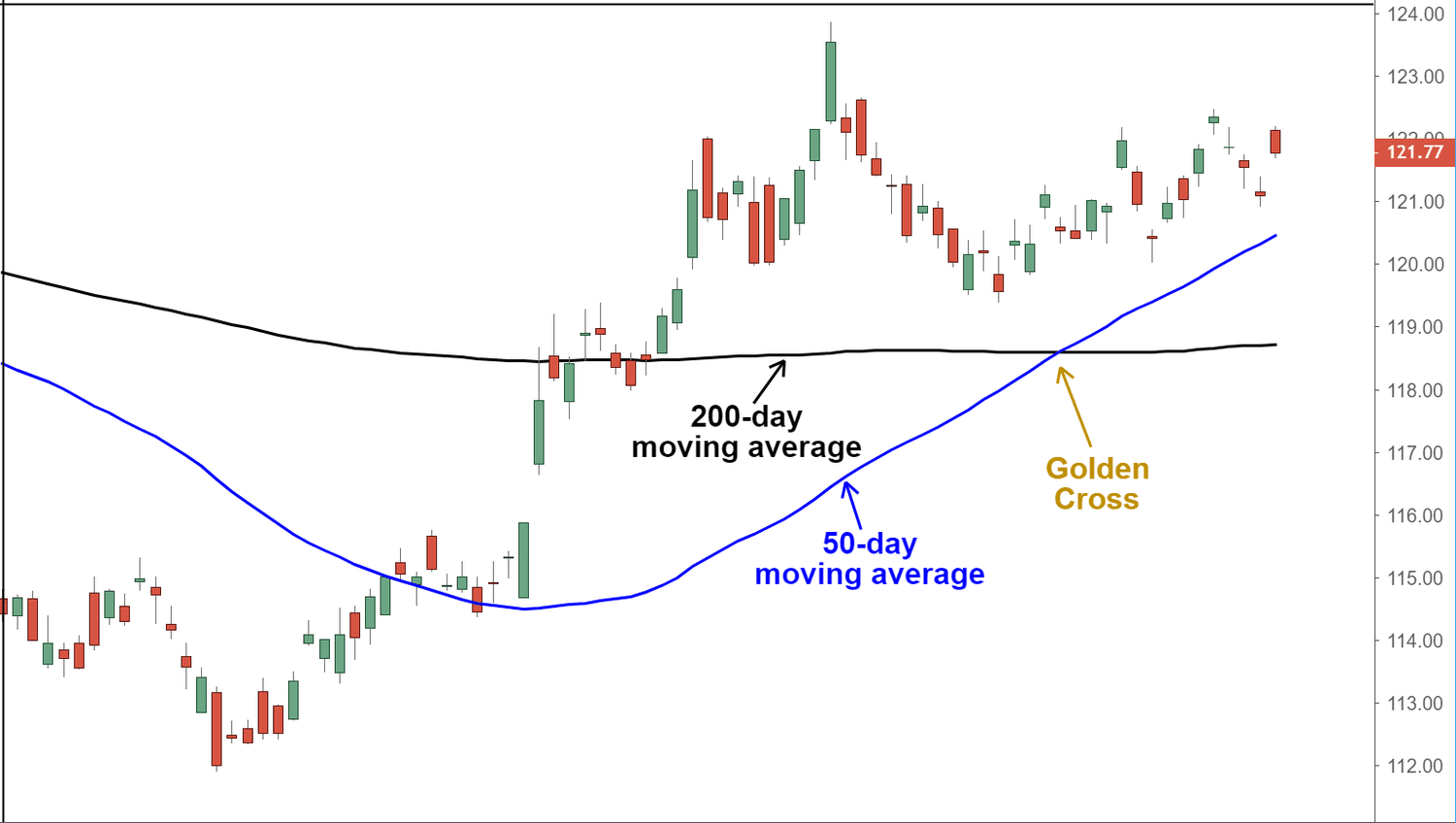

Got wrecked bad last month chasing meme stocks. Felt like throwing darts blindfolded. Then I stumbled on some dude ranting about how golden crosses saved his portfolio. The idea’s simple: when a short moving average (like 50-day) crosses above a longer one (say 200-day), boom — buy signal. Sounded like free money. Yeah, right.

My Half-Baked Setup

Grabbed my crusty laptop and fired up a free charting tool. Pulled up Apple’s historical data cause, well, everyone talks about Apple. Zoomed into 2020 like a detective hunting clues. First mistake: I eyeballed the cross dates instead of backtesting properly. Laziness bites hard.

Set my parameters:

- 50-day SMA (simple moving average)

- 200-day SMA

- No fancy indicators — keeping it barebones

The “Aha!” Moment That Wasn’t

Spotted the golden cross in April 2020. Chart showed Apple stock exploded right after! Felt like cracking the Da Vinci code. Got greedy and slammed cash into three random stocks showing fresh crosses:

- Tech company IPO’d 6 months ago

- Beaten-down travel stock

- Some EV startup hyped on Twitter

Dumb. Luck.

Reality Check & Adjustments

Tech stock mooned 20% in a week. Travel stock? Dipped 15%. EV play flatlined. No consistency. Felt like ordering mystery sushi — sometimes salmon, sometimes sea urchin guts. Dug deeper and realized:

- Volume matters. No volume spike? Probably fakeout.

- Works better in actual bull markets (not sideways chop).

- Delayed signals mean you miss early rallies.

Translated: Golden cross ain’t a crystal ball. It’s a weather vane — tells direction but not WHEN rain’s coming.

Live Testing & Pain Points

Tossed $500 real money into this experiment. Used a brokerage paper account too. Set alerts for crosses on S&P 500 blue-chips. Discipline tanked fast:

- Chased one cross after earnings report (got burnt)

- Panic-sold when a cross “failed” (stock rebounded next day)

- Ignored fundamentals completely (dumbest move)

Ended up with $23 profit after commissions. Not worth the stress-induced forehead acne.

The Takeaway

Golden crosses? Useful if you pair ’em with common sense. Now I use it ONLY as a confirmation tool. See bullish setup? Check if the averages crossed recently. DO NOT use it solo like I did.

Real talk: lost more cash obsessing over crosses than I made. But hey — lesson burned into my brain now. Saved a fortune dodging bad trades later. Sometimes losing teaches best.

Oh, and my cat now recognizes moving averages. If he paws at a golden cross on my screen? Even he knows it might mean dinner’s delayed.