Man, January 2023 was supposed to be about setting easy, chill goals, right? Like, ‘I’m gonna drink more water,’ or ‘I’ll stretch sometimes.’ Forget that. For me, and maybe you Virgos felt it too, January 2023 was a financial gut-punch that forced a total career shift. I didn’t choose the money moves; the lack of money chose me.

The Moment I Hit the Floor: Why I Started This Mess

I’d been coasting. I admit it. End of 2022, I thought my setup was solid—a stable primary job, a couple of decent side hustles that brought in some easy cash. I felt like I had that Virgo stability thing all locked up. Then, December hit me with two huge, unexpected bills within a week. First, my rusty old car finally gave out, a massive repair. Then, a surprise tax bill from a freelance gig I’d completely screwed up the bookkeeping on. I looked at the totals, and I felt sick. My emergency fund? Gone. Vanished. Just like that.

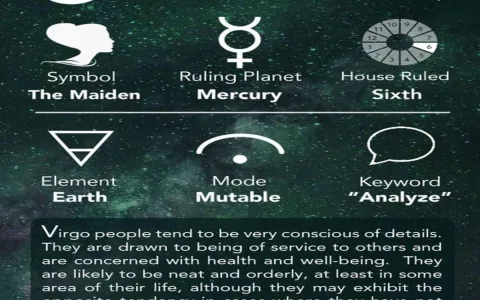

It wasn’t just losing the money; it was the failure of my own system. I’m a Virgo! I’m supposed to be organized! I realized all my “stable” setups were just a flimsy house of cards waiting for a strong wind. I couldn’t just keep doing what I was doing, waiting for the next disaster. The title, “Money moves for Virgo career January 2023,” wasn’t some cosmic advice I sought out. It was a damn emergency action plan I had to write for myself.

Drilling Down: My Four-Week Action Plan for Gains and Stability

I threw out all the fluffy goal-setting nonsense. I didn’t need a vision board; I needed cash flow. I locked myself down for the first four weeks of January and applied that classic, insane Virgo detail-work to my career and money. I started with a process that felt absolutely miserable.

Step One: The Financial Sledgehammer.

- I printed out every single bank statement from the last six months. Not just looked at them online. I printed the paper.

- I colored-coded every single transaction. Red for waste (streaming services I never used, that subscription box). Yellow for unnecessary but helpful. Green for non-negotiable necessities.

- I slashed away. I cut three unnecessary subscriptions on the spot. I called the internet provider and argued for a lower rate. I saved a quick $250 a month right then and there. It wasn’t major gains, but it stopped the bleeding. It gave me back control.

Step Two: The Career Focus Re-evaluation.

I realized my biggest mistake was thinking my time was a guaranteed asset. It wasn’t. My primary role was stable, but it had a clear income cap. The side gig was low-pay, high-time. I had to focus on leverage.

- I identified my unique, high-value skill—my ability to audit and organize large, complex data systems. Classic Virgo, right?

- I stopped applying for all the low-effort, low-return side projects. I told myself to aim higher.

- I committed to spending two hours every single night searching and applying for high-ticket, short-term consulting contracts that specifically needed that level of detail work.

Step Three: The Stability Play.

My entire fund was sitting in volatile investments. That’s a young man’s game. I needed sleep. I needed proof that my system wouldn’t collapse again.

- I dumped the high-risk, high-return garbage. I took the loss. It hurt, but the volatility was gone.

- I moved 80% of what was left into boring, high-yield savings accounts and Treasury bonds. Yeah, the returns are a joke, but my money is there. It’s locked down. It’s what actual stability looks like.

The Payoff: Securing the Major Gain and the Lesson

By the end of January, about three weeks into that insane regimen, the consistency started to work. I had two breakthroughs. First, I secured a three-month contract doing exactly what I targeted: auditing a small e-commerce company’s logistics data. The pay on that gig alone was almost double what my old, lazy side hustle brought in over six months. That was the major gain. I aimed small, but focused the effort on a high-value target, and it paid off.

Second, and this is the stability part, I built the habit. I now check those expense categories every single week. Not monthly. Every week. I created a firewall where 30% of that new contract money immediately gets shoved into the “untouchable stability fund” that I can’t easily access. I’m forcing myself into better habits.

The lesson I took from January 2023? Don’t wait for the stars or a fancy article to tell you where to focus. Wait for the pain. My financial stability came not from a lucky break, but from a forced, miserable period of cleaning up my own damn mess. The move for the Virgo career wasn’t some grand expansion; it was simply applying the details we’re famous for to the thing that actually pays the bills. It was brutal, but I got the money and the stability back, and I’m never letting it slip like that again.