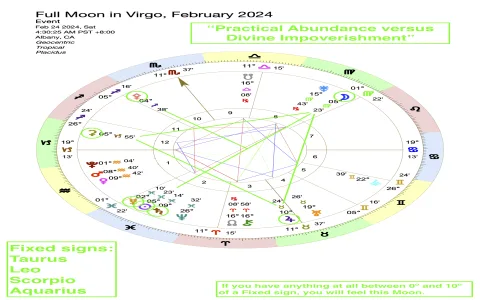

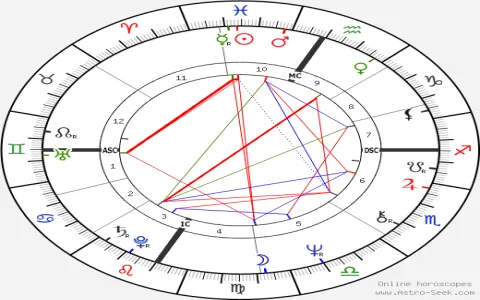

Man, sometimes you just hit a wall, right? Like, you wake up one day and it’s not even about what horoscope sign you are – though yeah, I’m a Virgo, always thinking, always planning, often overthinking. But it was less about what the stars said for my ‘2026 Career Path’ and more about what my gut was screaming. My gut was pretty clear: “Dude, figure your money situation out before 2026 slaps you in the face.”

I remember it was late 2023, maybe early 2024. I was punching the clock, doing the usual grind, and just feeling… flat. Not bad, not great, just flat. The bills were paid, sure, but there wasn’t much left over. And the thought of another two years of the same, leading right into 2026, made me pretty antsy. I started asking myself, “Is this it? Is this what my financial future looks like?”

Hitting the Drawing Board (My Kitchen Table)

First thing I did, honestly, was just sit down with a plain old notebook and a pen. I didn’t open any fancy apps or spreadsheets. I just started scribbling. I wrote down everything I was spending money on. Like, everything. Coffee, subscriptions I barely used, that weekly takeout – it all went down. Then, next to it, I wrote down what I wasn’t spending on but probably should be, like a proper savings plan or investing anything. It was a messy, eye-opening list, trust me.

After that, I flipped the page and started on my career stuff. I just dumped all my job worries and even my job dreams onto the paper. I wrote down what I liked about my current gig, which was not much, and what I hated, which was a longer list. Then I started brainstorming: “What am I actually good at?” and “What do I enjoy doing, even when I’m not getting paid?” It wasn’t about finding a new job right away; it was about getting everything out of my head.

The Talk-It-Out Phase

Once I had all that messy info, I didn’t jump into job applications. Nah, I started talking to people. Not like formal networking events, just casual chats. I grabbed coffee with an old college buddy who seemed to be doing really well. I just asked him, “So, what’s your secret, man? How’d you get to where you are?” He didn’t give me any grand advice, just told me his own screw-ups and successes. That was super helpful because it made me realize everyone’s just figuring it out.

I also called up my aunt. She’s always been pretty savvy with money. I didn’t ask for handouts, just picked her brain. “How did you manage to buy that house?” “What was your first real investment?” She told me about starting small, really small, and just being consistent. It was simple stuff, but hearing it from her, someone I trusted, made it click differently than reading some article online.

- Listened to podcasts: Found a couple of finance and career podcasts, just put them on during my commute.

- Watched YouTube videos: Not the gurus selling courses, but people sharing their real journeys, their budgeting hacks.

- Read a few biographies: Saw how people built their careers from nothing. It was inspiring and grounding.

Dipping My Toes In

After all that intel gathering, I felt like I had a clearer picture. My current job wasn’t going to cut it for the 2026 financial goals I was starting to sketch out. So, I decided I needed a new skill. Not a huge career change, just something to add to my toolkit.

I decided on picking up some basic data analysis stuff. Sounds fancy, but I just started with a free online course. Literally, just signed up and started plugging away for an hour or two every evening. Some nights I was tired, some nights I just wanted to binge-watch TV, but I pushed through. It wasn’t always smooth. I hit some roadblocks, got stuck on a few concepts, but I kept at it.

Around this time, I also started tinkering with a little side hustle idea. Something related to my hobby, something I enjoyed. It was small, super small, just making a few bucks here and there from something I actually liked doing. It wasn’t about getting rich, it was about proving to myself that I could create another income stream, no matter how tiny. That feeling was empowering.

The Big Pivot

By mid-2024, I felt ready. I had clearer financial goals: paying off a chunk of my student loan, building a solid emergency fund. And I had a new skill, or at least a foundational understanding of one, plus a tiny bit of side hustle proof.

I updated my resume, focusing on the new skills I was learning and how they could apply to new roles. I started applying for jobs that were a step up, jobs that required that little bit extra. I got some rejections, sure, but I also got interviews. Each interview was a practice run, helping me articulate my new value.

Finally, after a few months of applying and interviewing, I landed a new role. It wasn’t a complete industry jump, but it was a different department, a new challenge, and most importantly, a noticeable bump in pay. It also put me in a position where I could keep building on those data skills I had started learning. The side hustle? Still chipping away at it, growing slowly.

Looking Towards 2026

Now, heading into 2026, I feel a whole lot better. I’m not loaded, but I’m stable. My savings are actually growing, and I have a clear plan for paying down debt and even putting some money into a proper investment account. My career path isn’t a straight line, but it’s moving upwards, and I actually feel engaged in what I’m doing. It wasn’t some magic astrological prediction that got me here, it was just sitting down, getting real with myself, talking to folks, and putting in the work, little by little, day by day.