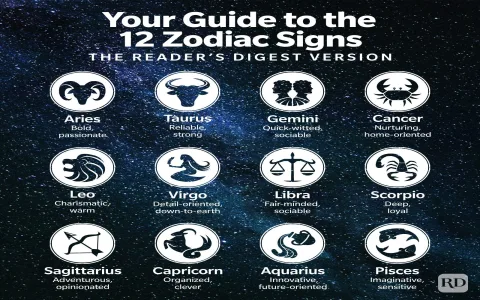

Back in August 2018, I decided to take control of my money as a Virgo. I started by looking at my bank statements. I sat down at my old desk, grabbed my glasses, and just stared at those papers. It was like a battlefield of numbers.

Step 1: Figure out where the money was going

I took a pen and started marking off all the expenses. Groceries, that was a big one. I realized I was spending way too much on those fancy organic snacks. I made a list of all the unnecessary things I was buying. Eating out? Yeah, that had to go. I was like a detective, tracking down every single cent that was slipping through my fingers.

Step 2: Set up a budget

I got a notebook and divided it into sections. One for bills, one for groceries, and one for entertainment. I decided to limit my grocery spending to $300 a week. For entertainment, I set aside only $50. It was tough at first. I really wanted to go to that new movie, but I had to stick to my plan. I even started cooking at home more often. It was like a game, seeing how much I could save by making my own meals.

Step 3: Look for extra income

I started looking around for ways to make some extra cash. I sold some old clothes and books online. It was like a treasure hunt in my closet. I also took on a part – time job delivering newspapers on weekends. It was early in the morning, and it was cold, but the extra money was worth it.

Step 4: Track my progress

Every week, I sat down again and checked how much I had spent and how much I had saved. I used a simple spreadsheet on my laptop. I could see the numbers changing, and it was so satisfying. When I saw that I was under budget for groceries, I felt like a champ.

Step 5: Make adjustments

As the month went on, I realized that my entertainment budget was too low. I was feeling really stressed out, and I needed some fun. So, I bumped it up to $80. And I found that I could cut down on my utility bills by turning off lights when I left a room. It was like a constant balancing act.

By the end of August 2018, I had saved a good amount of money. I was able to pay off some of my credit card debt. It wasn’t easy, but taking control of my money management was totally worth it. I learned that with a little effort and some smart planning, anyone can make the most of their money.