Man, lemme tell you about back in 2014, heading into 2015. My money situation was just a complete and utter mess. I mean, not just tight, but confusing. I was constantly playing catch-up, felt like I was always reacting to some surprise bill or an empty wallet. Every month felt like a lottery I never won, and I was just kinda floating along, hoping for the best but always expecting the worst. It was stressing me out something fierce, kept me up at night, all that jazz.

Then, around late 2014, something just snapped. I got hit with this completely unexpected car repair bill, way bigger than anything I had saved. It wasn’t just the bill; it was the feeling of being totally powerless, like I had no control over my own life, my own finances. That was it. I decided right then and there I had to figure something out, had to do something different. No more just wishing things would get better. I had to make them better.

So, I started scrambling. I dove headfirst into all sorts of “expert” advice online. You know the drill, right? Read a bunch of articles, watched some videos. Tried this one system where you had five different bank accounts for different things. That lasted maybe two weeks before I was totally lost, money going in and out of all these places, couldn’t keep track. Then I tried a super strict budget, like, down to the penny for everything. That was a total nightmare. Felt like I was depriving myself of everything fun, got super irritable, and, surprise, surprise, I broke it after about five days and just blew a bunch of cash out of sheer frustration. It just didn’t work for jack.

I tried fancy apps, spreadsheets, everything. But nothing stuck. It always felt so impersonal, like it was designed for someone else, not for me, a Virgo who, let’s be honest, tends to overthink everything and get bogged down in details. I was looking for external solutions, but the real problem was internal. My own habits, my own reactions to things. And that’s when it hit me: if I wanted to avoid financial pitfalls, I had to understand my own pitfalls first.

That realization changed everything. I ditched the complicated systems and just grabbed a cheap, plain notebook, one of those spiral-bound ones. I decided I wasn’t going to budget at first; I was just going to observe. I started simple:

- I’d scribble down every single time money came in.

- Then, I’d write down every single time money went out.

- But here’s the kicker: next to each expense, I’d add a quick note about how I felt when I spent it, or why I thought I spent it. Was I bored? Stressed? Rewarding myself?

I did this for a few months, just tracking, no judgment. By the time December 2014 rolled around, and definitely by January 2015, I started to see patterns. Like, clear as day. I noticed that every time I had a particularly tough week at work, I’d splurge on takeout or some online shopping. Or how certain times of the month, usually right after I paid the big bills, I’d feel “richer” for a few days and overspend, only to regret it later.

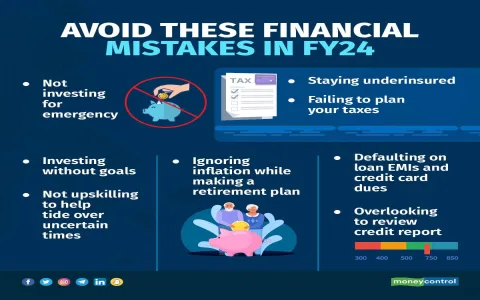

This wasn’t about some universal money forecast; this was my money forecast, based on my behaviors. I started realizing that some “financial pitfalls” weren’t unexpected external events, but predictable internal ones. Especially being a Virgo, I tend to get caught up in details and can get analysis paralysis, which sometimes led to impulsive spending as a way to “break free” from overthinking. And February 2015 was looming, a month that, based on my past few years, often brought unpredictable expenses or just a general feeling of “blah” that led to comfort spending.

So, heading into February 2015, I didn’t have some magic crystal ball, but I had a clear picture of my own weaknesses. I anticipated the usual mid-winter blues, the post-holiday slump that made me want to treat myself. I looked back at my notebook and identified common triggers. For example, I knew that being stuck indoors too much always made me restless and led to online shopping. So, I planned for it. Instead of just trying to “not spend,” I actively sought out free or cheap alternatives like library books, long walks outside even if it was cold, or calling up a friend for a cheap coffee instead of buying something I didn’t need. I even set aside a small, defined “mood booster” fund – literally a twenty-dollar bill I kept separate, so if I felt that urge to splurge, I could use that specific twenty, no more, no less, on something small to genuinely lift my spirits, rather than letting it spiral.

And you know what? February 2015 wasn’t perfect, nobody’s ever perfect with this stuff, but it was so much better than previous Februaries. I avoided several major financial pitfalls that I had seen coming. It wasn’t about being rich; it was about feeling like I finally had a handle on things, like I was driving the car instead of just being a passenger. That little notebook, that simple act of just watching and understanding myself, that’s what really made the difference. It taught me that the best financial forecast isn’t about the stars, it’s about knowing yourself.