Man, sometimes you just get stuck in a rut, right? My whole financial situation felt stagnant lately, like I was hitting a ceiling I couldn’t punch through. I was looking for a fresh angle to review my budget, something to shake up my usual boring spreadsheet routine. Then, last Saturday, while I was cleaning out my old desktop files—the digital junk drawer—I stumbled across the stupidest thing: a saved image file titled “Virgo Career Prediction 2018.”

I must have saved it back when I was panicking about leaving my old job. It was pure internet garbage, full of fluff about “unexpected financial windfalls” and “cosmic alignment leading to career breakthroughs.” I usually just delete this stuff instantly, but this time, the sheer absurdity of reading a six-year-old, generic horoscope made me pause. I thought, wouldn’t it be hilarious—and maybe useful—to treat this dumb prediction as a hypothesis? Was my current financial reality actually tied to the energy I was chasing in 2018?

I decided to commit fully to the bit. I wasn’t looking for magic; I was looking for the patterns I had completely missed when I was making money decisions under pressure back then. This wasn’t about the stars; this was about the cold, hard receipts.

Wrestling with the Ghosts of Paychecks Past

The first step was to gather all the materials. I pulled up my current net worth statement and then immediately jumped into the archives. I had to dig through old tax forms, bank statements, and investment contribution logs spanning from January 2018 through December 2023. It took almost five hours just to consolidate the spreadsheets.

I started the actual mapping process. I isolated three major career moves I made in the 2018-2019 window: starting a small consulting side hustle, taking a certification course that cost a fortune, and finally landing the job I’m in now.

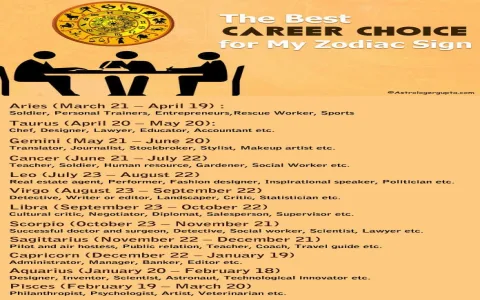

- I tracked the exact timeline of the consulting hustle. The horoscope predicted a surge in passive income mid-year. I cross-referenced the prediction with my actual revenue reports. What did I find? The income surged alright, but only after I hired a virtual assistant to handle my invoicing—an action I took, not the cosmos.

- I analyzed the expense data for that expensive certification course. I remember feeling paralyzed about dropping that much cash. The horoscope claimed “Virgos should invest heavily in education.” I mapped the course investment against my eventual salary increase. The increase was real, but it was purely because the new job required the certification, not because some planet told me to buy it.

- I went through my investment records for 2018. I uncovered two terrible impulse buys of individual stocks that I panicked and sold at a loss in 2019. This was supposedly my “financial windfall” period. I realized I was just chasing hype, completely ignoring my own risk tolerance.

The entire process forced me to confront the fact that my financial foundation was built on a series of reactionary decisions, not conscious, well-researched steps. The horoscope was irrelevant; the sloppy decision-making was the real discovery.

The Unlock: Implementing Real, Hard Changes

After I finished the audit and compared the cosmic BS to the bank balance truth, I realized the value of this whole exercise wasn’t about validating astrology. It was about creating mandatory, retrospective accountability. It lit a fire under me to fix the bad habits I had accidentally carried forward from 2018.

I immediately scrapped my complex, monthly budgeting system that I kept failing to stick to and implemented a simple ‘zero-sum’ allocation right when the paycheck hits. I moved my investments from scattered accounts into one centralized, simplified brokerage.

Here’s what I executed within 48 hours of finishing the financial mapping:

- I cancelled three redundant SaaS subscriptions that were costing me over $60 a month. I identified this recurring bleed because my 2018 files showed I signed up for them during a “growth hacking” phase and never cancelled. That $60 is now auto-transferred into my debt payment account.

- I set up automated deposits into my high-yield savings account the moment my paycheck clears. I stopped relying on mental willpower to transfer savings at the end of the month.

- I created a ‘Decision Log’ for all investment purchases. Before I buy anything new, I now write down the exact reason why and what criteria I’m using, so I can’t hide behind “the stars” or internet buzz next time I review it.

The old horoscope was total garbage, but it served its purpose brilliantly. It was the arbitrary starting gun I needed to drag my financial history out into the daylight and force a genuine, painful clean-up. Don’t wait for a sign from the universe; sometimes, you just need a silly, random idea to get you moving and start tracking your own damn progress.